contra costa county sales tax calculator

2020 rates included for use while preparing your income tax deduction. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 923 in Contra Costa County.

Sales Tax Calculator And Rate Lookup Tool Avalara

Denotes required field.

. The total sales tax rate in any given location can be broken down into state county city and special district rates. CA Rates Calculator. Contra Costa County Home values.

This 225 difference is. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. If you intend on using a check please make sure the address on the.

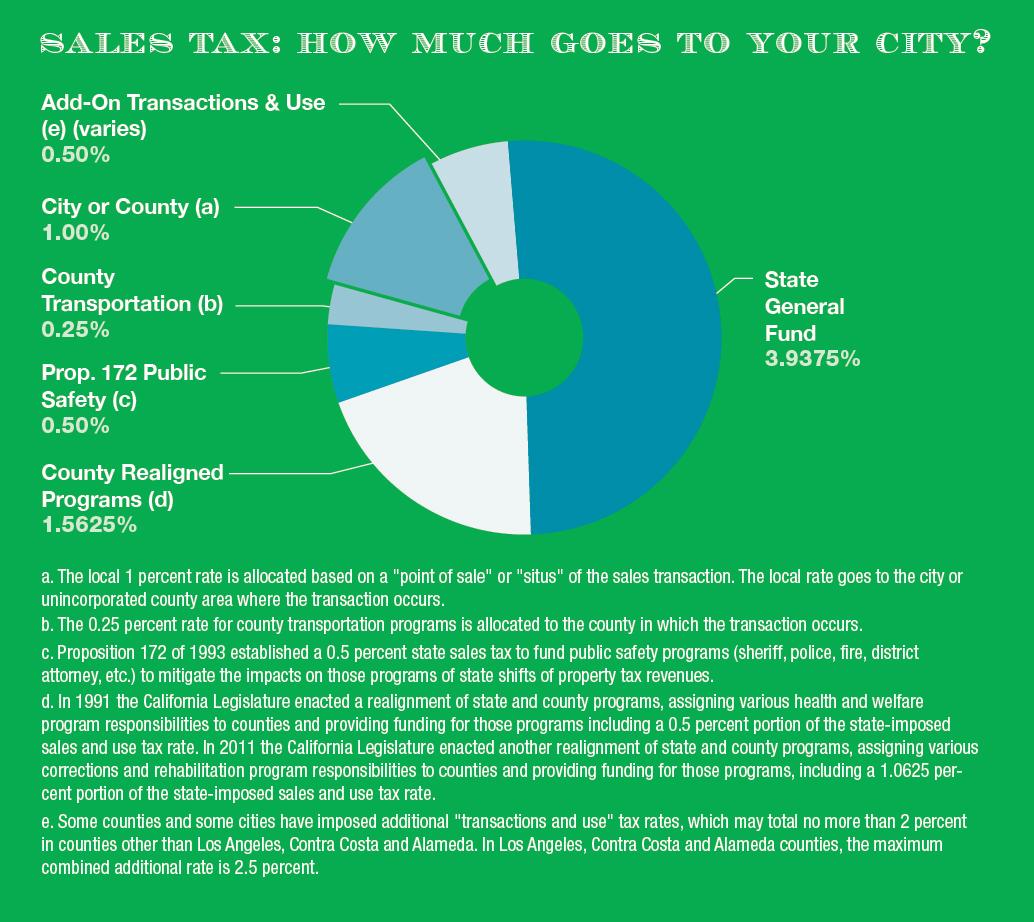

A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax. Buy and sell with Zillow 360. Find a more refined approach to sales tax compliance with Sovos.

Ad Need a dependable sales tax partner. Home Sale Calculator. This rate includes any state county city and local sales taxes.

Method to calculate Contra Costa County sales tax in 2021. This rate includes any state county city and local sales taxes. The median property tax also known as real estate tax in Contra Costa County is 388300 per year based on a median home value of 54820000 and a median effective property tax rate of.

Welcome to the Tax Portal. CA Rates Calculator. For comparison the median home value in Contra Costa County is.

The minimum combined 2022 sales tax rate for Contra Costa County California is. Even everyday living in Contra Costa County is more expensiveas one indicator while the sales tax rate in California is 6 sales tax in Contra Costa County is 825. 2020 rates included for use while preparing your income tax deduction.

Credit and debit cards are subject to an additional service fee. 714 516-6700 866 724-1050. Welcome to the TransferExcise Tax Calculator.

The December 2020 total local sales tax rate was 8250. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price. 625 Court St Ste 102 Martinez CA United.

Calculator Mode Calculate. Sovos is your sweet spot for sales tax compliance. As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

Bundle buying selling. US Sales Tax calculator California Contra Costa. What is the sales tax rate in Contra Costa County.

CA is in Contra Costa County. We accept cash pre-printed checks credit and debit cards. Find a sellers agent.

Weve collated all the information you need regarding Contra Costa taxes. The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025. The Contra Costa County Sales Tax is 025.

This is the total of state and county sales tax rates. The base sales tax in California is 725You can also use Sales Tax calculator at the front page where you can fill in percentages by. Watts was first elected in June 2010 as Treasurer and Tax Collector of Contra Costa County Watts is responsible for the collection safeguarding and investment of over 35.

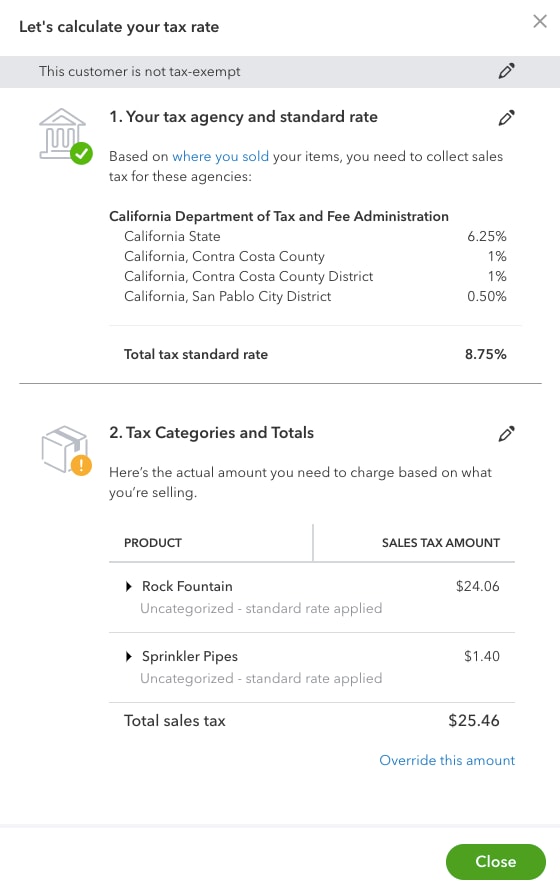

The current total local sales tax rate in Contra Costa County CA is 8750. Please visit our State of Emergency Tax Relief page for. The Contra Costa County California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Contra Costa County California in the USA using average.

This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price. Peruse rates information view relief programs make a payment or contact one of our. The minimum combined 2022 sales tax rate for Contra Costa County California is.

Contra Costa County in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Contra Costa County totaling 075. Post For Sale by Owner. 1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more.

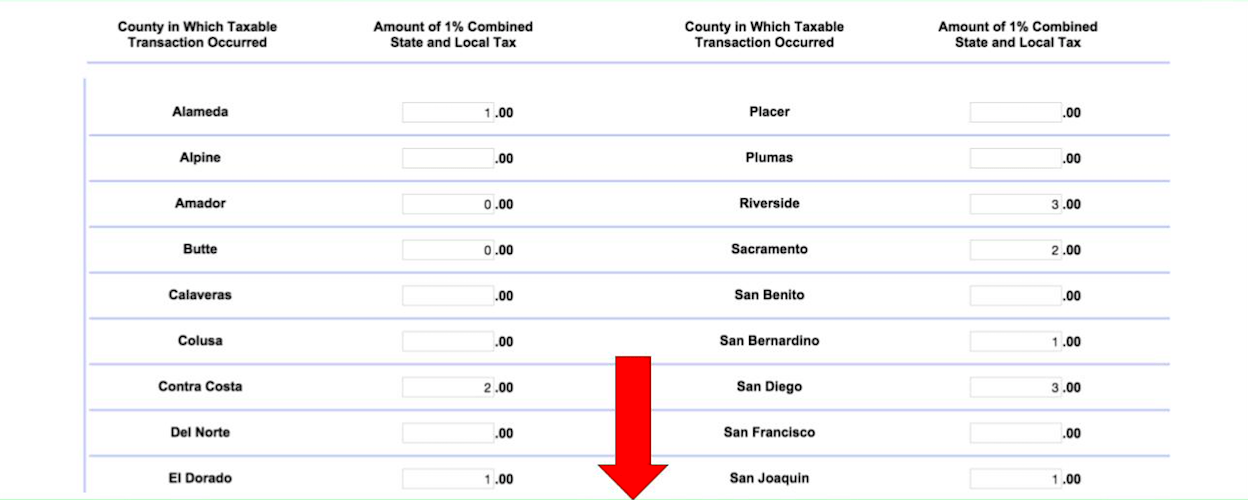

Sales Tax Table For Contra Costa County California. If you need to get in touch with the Contra Costa County Treasurer- Tax Collector here are some relevant information for you. 120 Orange CA 92867.

CA is in Contra Costa. This county tax rate applies to areas that are within the boundaries of any incorporated cities within the Del. Puerto Rico has a 105 sales tax and Contra Costa County collects an.

How To Calculate Cannabis Taxes At Your Dispensary

Food And Sales Tax 2020 In California Heather

Coronavirus Updates The Business Assistance Program Lafayette Chamber Of Commerce

San Francisco Property Tax Rate Set To Drop 0 23 Percent

California Sales Tax Calculator Reverse Sales Dremployee

Transfer Tax Calculator 2022 For All 50 States

A Primer On California City Revenues Part Two Major City Revenues Western City Magazine

Sales Tax Calculator And Rate Lookup Tool Avalara

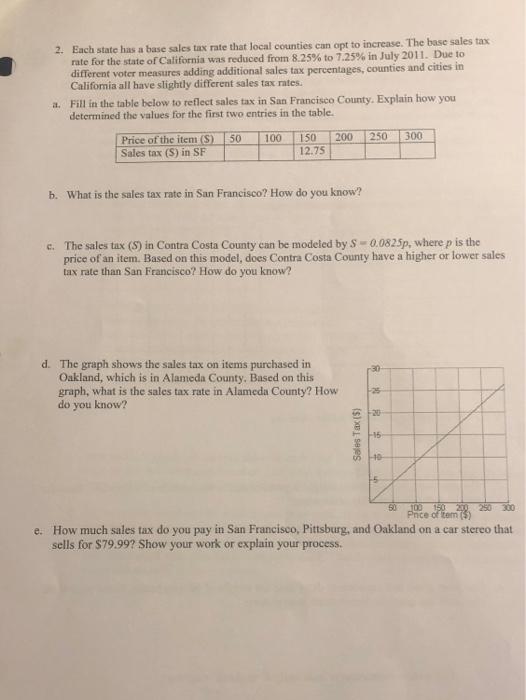

Solved Can You Help Me I Dont Understand Help With Number Chegg Com

My Accountant Said My Sales Tax Are Being Coding Incorrectly They Need To Be Payable Can I Correct The Settings And How

Property Tax How To Calculate Local Considerations

Understanding California S Sales Tax

Ecommerce Sales Tax Basics For X Cart Merchants From Taxjar

Property Tax By County Property Tax Calculator Rethority

San Diego County Ca Property Tax Faq S In 2022 2023

Property Tax By County Property Tax Calculator Rethority

Sales Taxes In The Bay Area Will Increase April 1

Frequently Asked Questions City Of Redwood City

Fillable Online Boe Ca California City And County Sales And Use Tax Rates Tax Rates Effective 1 1 13 To 3 31 13 Boe Ca Fax Email Print Pdffiller